IT Carve-Out Services

RKON Carve-Out Approach

Over the past several years the private equity industry has seen significant growth, both in new funds launching and emerging private equity firms. As a result, the demand for carve-out deals has exceeded supply. However, as more firms with more traditional investment tendencies seek more niche investments such as carve-out opportunities, we have seen demand rise.

Carve-out transactions usually start with a large enterprise parent company that is selling a division, in its entity, to a private equity firm who will then run the business as an independent entity. Carve-outs can be very profitable if done correctly, but more often than not, organizations underestimate the complexity of the IT portion and the impact of making the wrong decisions early in the process. Cost-optimized, secure, high-performing IT is created during the transition, not “sometime” later during the hold period when the focus needs to be on value-creation.

To unlock the complexity of your transition, here is our accurate and proven approach to help you measure and drive value within each and every transaction.

Effective Carve-Out Execution

Because mergers involve a multitude of intricate processes, the delivery team must be able to manage many moving parts. The creation of a stand-alone entity in a matter of weeks is daunting by itself, not to mention the added lack of cooperation from the legacy organization or the attrition of employees, which creates a chaotic, disparate work environment. RKON helps clients to determine the most favorable level of IT sourcing and to implement the most appropriate technology for the new business unit — all to promote flawless execution.

“Our organization was bought by a private equity firm as a carve-out from our parent company. RKON was able to seamlessly execute a migration plan well in advance of the TSA and with zero downtime and business disruption. The RKON team even took ownership for things outside their scope to ensure success.”

– CIO of High Growth Carve-out

Common Carve-Out Mistakes

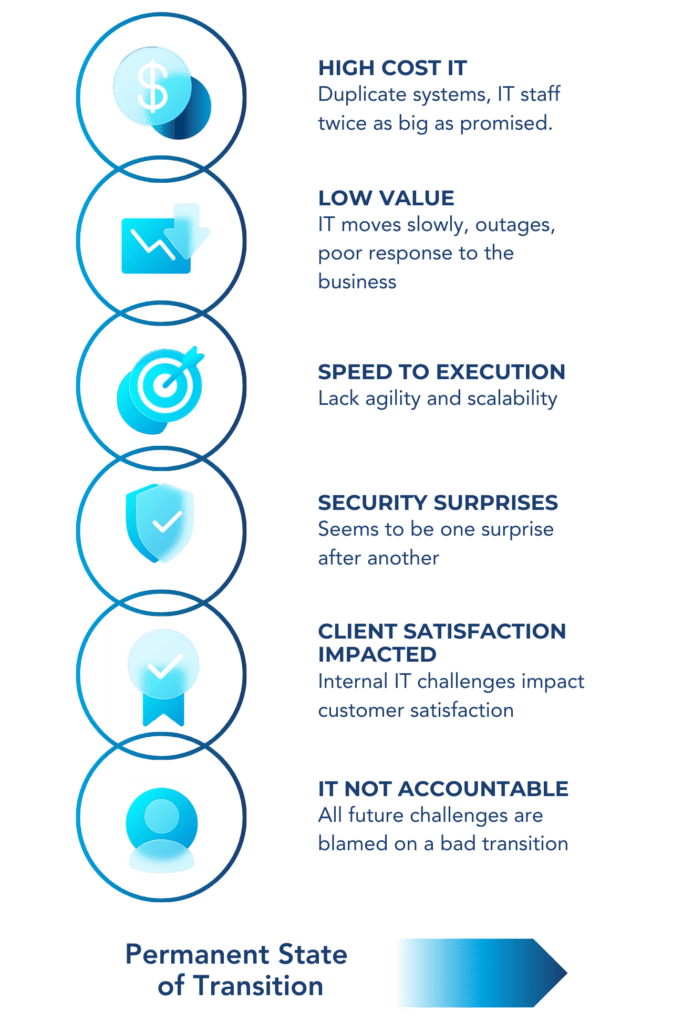

Many carve-outs fail because of inadequate IT planning and a lack of knowledge around infrastructure, costs, and security. This results in private equity having higher than anticipated costs, underperforming assets, and an increase in risk. The two most common mistakes:

1. Automatic Adoption of Parent Company’s IT Blueprint: Migrating the existing high cost structure of the parent company instead of rightsizing.

2. Using a Traditional Advisory Playbook: This approach to carve-outs is more transitional as opposed to transformational.

Elite Carve-Out Team

Constructing a team for diligence, planning, and design that can also focus on short-term, intense analysis and convert abstract, detailed processes into a meaningful strategy is key to accomplish a successful transition. Not to mention, consultants should be profiled to know who’s best suited to handle the stress and pressure of these projects, as well as which creative thinkers can overcome unforeseen obstacles and avoid all distractions for an efficient TSA exit.

As a leading IT transformation advisory practice, our team has deep consulting and execution expertise in carve-outs, mergers and acquisitions, platform creation, and operations management.

Our industry experience is rooted in our passion, integrity, and commitment to finding the best-possible IT solutions for our clients. Contact us and learn more about our IT carve-out services.

Contact Us Today

If you are looking for more information about our IT Transformation & Security services please don’t hesitate to reach out. Our team of IT experts is ready to help.